Audit and Assurance

Taxation

Grants Management

Company Secretarial Services

Sub-recipients Management

Business Support – Companies & NGOs

Audit and Assurance

ThornFlex provides auditing services and assurance service to Public and Private Companies, Governmental and Non-Governmental Organizations.

Auditing and assurance services are important for businesses, and organizations, of any type and size. The modern day financial reporting environment is highly exposed to the never-ending changes in local and global requirements. In conducting an audit, business owners have to use certain acceptable methods while still complying with rules and regulations. Our services enhance the confidence of users of financial statements by giving logical, relevant and easy to use data and information sets.

Moreover, audit and assurance helps you to see the bigger picture of your company as well as its financial standing to support you in making intelligent business decisions based on facts and records.

ThornFlex offers the following range of audit and assurance services, tailored to meet your requirements:

- Statutory financial audit

- Agreed upon procedures audit

- Project audit

- Forensic investigations

- Special audit and investigations

- Internal audits

- Performance and management audit

- Technical advice and interpretation

Taxation

We help businesses to maximize value by identifying and implementing comprehensive strategies for corporate, international and local taxes. This helps ensure that the flowing effect of all taxes together is minimal on our clients.

ThornFlex offers the following range of tax services, tailored to meet your requirements:

- Income tax accounting

- Management of income tax returns

- Employment tax services

- Tax health check

- Tax planning

- Filing VAT Claims

Company Secretarial Services

We offer a full range of company secretarial services in Tanzania ranging from new company and non-profit organizations formation and incorporation in Tanzania, provision of registered office facilities, right up to providing assistance at the Board meeting and shareholders general meeting and documentation.

Moreover, we offer the latest updates on legislative changes and ensure all compliance needs are taken care of including:

- Registering and set up of public companies and private limited companies, enterprises and other types of organization like trust bodies and non-profit organizations.

- Registration of foreign companies or representative / branch office in Tanzania, deregistration, liquidation & wind-up of companies

- Facilitating permits and licenses from different Government Authorities.

- Advising and facilitating foreign clients in applications for Work Permits, Resident Permits and National ID for foreigners in Tanzania.

- Preparing and filling of Company annual returns.

- Registering of Patent and Trade Mark

- Processing of share transfers and allotments.

- Call for shareholders and Directors meetings, taking minutes, attending any consequential statutory matters arising out of these meetings.

- Receivership and Insolvency.

- Drafting and certification of Corporate and Legal Documents such as Employment Contracts.

- Legal Research and Writing

- Advising on land issues in Tanzania including acquisition and transfer.

- Provide in house training and advisory services on Labor Law, The Companies act of Tanzania, The Non-Governmental Organizations Act and Industrial specific laws and regulations.

Business Support – Companies

Our business support services enable our clients to reduce their administrative burden and leave them time to focus on their core business activities while remaining compliant to their internal policies, as well as national & regional Laws and Regulations. At ThornFlex we provide a range of tailored business support services to give you the freedom to get back to running your business more effectively.

- Business Plan and Operation Manual development to include: Business Plan and Operations manual writing on Financial Management, Human Resource Management, Asset Management, Information and Communication Technology Management, Procurement and logistics management.

- Outsourcing of accounting services: This includes maintenance of the books of accounts, review financial documents for compliance and accuracy, processing VAT refunds from the government, Payroll preparation, processing and submission of statutory returns, producing financial reports as required and supporting donor audits.

- Outsourcing of Internal Auditing and Value for Money assessment: We conduct periodical internal audit services and Value for Money assessment on behalf of the organization.

- Outsourcing of Assets Management: Property Count, Property valuation, Property Coding and Property Register Preparation.

- Outsourcing of Payroll Management: We manage the entire Payroll Process on behalf of clients

- Outsourcing of Staff Recruitment: We support our clients identify right skills.

Business Support – NGOs

Supportive Systems and processes

When it comes business support systems and processes, NGO’s occupy a special place on the Organization Development continuum. Our business support services enable our NGO clients to reduce their administrative burden and leave them time to focus on their core business activities while remaining compliant to their internal policies, donor requirements as well as the various laws and regulations. At ThornFlex we provide a range of business support services to give NGO’s the freedom to get back to running business more effectively.

- Strategy and policy development: We design and review strategies and policies on Financial Management, Human Resource Management, Asset Management, Information and Communication Technology Management, Procurement and logistics management that are aligned with the laws and regulations.

- Outsourcing of accounting services: This includes maintenance of the books of accounts, review financial documents for compliance and accuracy, processing VAT refunds from the government, Payroll preparation, processing and submission of statutory returns, produce financial reports as required and supporting donor audits.

- Outsourcing of Internal Auditing and Value for Money assessment: We conduct periodical internal audit services and Value for Money assessment on behalf of the organization

- Outsourcing of Assets Management: Property Count, Property valuation, Property Coding and Property Register Preparation.

- Outsourcing of Payroll Management: We manage the entire Payroll Process on behalf of clients.

- Outsourcing of Staff Recruitment: We support our clients identify right skills.

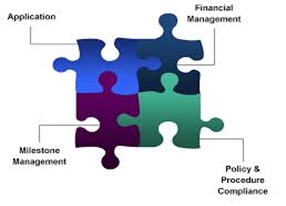

Grants Management

We support our clients by proving Grants Management Consultancy services. These include:

- Developing guidelines and assessment criteria for funding applications and proposal.

- Support NGO’s to identify and commission grant recipients

- Conduct a Call for Proposals process from start to finish, including evaluating concept notes and proposals, identifying suitable recipients of innovation funds and ensuring that each undergoes a fiduciary and management assessment with grant recipient organizations on disbursement schedules and reporting requirements and prepare funding agreements for individual grantees.

- Coordinate and oversee the review and approval of grantees’ budgets (forecasting and spending), work-plans and accounting systems, with the help of a dedicated ThornFlex accounts associate

- Retain oversight of the grants budget and the Fund account, contributing as necessary to quarterly disbursement reports, accounts and cash forecasts, and contributing to ensuring compliance with financial management regulations.

- Coordinate, as necessary, with partners implementing other components of the same program

- Contribute to risk mitigation plans based on experience with grantees

- Contribute as necessary to a knowledge management system for sub-recipients and grantees.

Sub-recipients Management

We support our clients by proving Sub Recipient Management Consultancy services. These include:

- Performing Due Diligence of Sub recipients in behalf of the organization.

- Ensure that sub-agreement management process for local and international sub-recipients are in line with the project agreement.

- Ensure that institutional capacity of partners is strengthened through organizational, financial and administrative system enhancement.

- Plan and maintain a monitoring regime for sub-agreement work, in order to ensure that donor funds are effectively and efficiently utilized in compliance with applicable laws and donor/ Principal Recipient regulations.